Introduction

Time and again, it has been proven that high levels of employee engagement lead to increased productivity, higher retention rates, improved customer service, and increased profits. On the other hand, burnout and poor employee engagement can lead to high attrition rates and a loss of productivity causing a dent in the organization’s economic functions.

The criticality of continually practicing employee engagement initiatives has never been more pressing. Employee engagement has helped many businesses steer through storms, such as the Great Resignation and Quiet Quitting of the past year. Not that these storms have completely cleared, but with the inevitable global recession looming in 2023, employee engagement is more important than ever to keep employees motivated and committed to their jobs.

However, employee engagement initiatives such as training programs, team-building activities, and improved benefits can increase costs for a company. And, it is not the kind of news your finance department wishes to hear in the middle of an economic downturn. Thus, you might have to face challenges in getting your plan approved by the finance department or the CFO, given the current circumstances.

This blog will take you through how a clear financial case can be made for employee engagement, specifically when presenting to a CFO or senior finance person who must approve the budget.

The business case for employee engagement

McKinsey & Company’s research on employee turnover found that uncaring leaders, unsustainable work expectations, and a lack of career development opportunities were the top reasons for employees leaving a job, each at 35%. This highlights the importance of practicing comprehensive and tailored employee engagement programs.

It is important to understand that there is a direct connection between employee engagement initiatives and specific financial metrics and KPIs that align with the CFO’s priorities. Merely improving employee engagement or morale alone may not be sufficient to secure funding. But, explaining how employee engagement can make a quantifiable difference, can help your case.

Here are a few business use cases for employee engagement that you must explain to the CFO:

Increased employee productivity

Engaged employees are more productive because they are more motivated and invested in their work. They are also more likely to go above and beyond in their roles and take ownership of their responsibilities. Engaged employees make better use of time and are always trying to find innovative ways to solve the most challenging problems. This leads to increased efficiency and effectiveness within the organization.

Higher retention rates

Engaged employees are less likely to leave their jobs, which can save an organization significant amounts of money in terms of recruitment and training costs. Higher employee attrition rates are detrimental to the health of an organization. High levels of employee engagement also lead to a positive work culture and a strong employer brand, making it easier to attract top talent.

Improved customer service

Engaged employees are more likely to provide excellent customer service because they are committed to the success of the organization and want to deliver a positive experience for customers. This can lead to increased customer satisfaction and loyalty, which is essential for any business.

Increased profits

As mentioned earlier, organizations with high levels of employee engagement have been shown to have higher operating income and earnings per share. This is because engaged employees are more productive and efficient, leading to increased profitability.

“Although the immediate payoff may not be obvious, investing in an engaged workforce may pay dividends in the form of reduced recruiting and training expenses in the years to come. The potential downside of ignoring employee engagement is another viewpoint to think about. Turnover caused by disgruntled workers may be costly to both the company’s productivity and reputation.”

Measuring the ROI of employee engagement

The relationship between employee engagement and revenue is complex and can be affected by a variety of factors, but in general, engaged employees tend to be more productive, motivated, and committed to achieving company goals which can contribute to increasing revenue.

Several studies show a correlation between employee engagement and increased revenue. Here are a few statistics that demonstrate this relationship:

- A study by Aon Hewitt found that companies in the top quartile for employee engagement had 2.5 times higher earnings per share (EPS) growth than companies in the bottom quartile.

- According to Towers Watson Global Workforce Study, Companies with engaged workforces boast an average of 19% higher operating income and 28% higher growth in earnings per share (EPS) than the average employer. Companies with unengaged workforces averaged 34% less operating income and 11% lower EPS growth.

- A report by Forrester shows that a 5% enhancement in employee engagement can lead to a 3% rise in bottom-line revenue.

Your CFO needs to know the return on investment (ROI) of your employee engagement initiatives. So that they can make an informed decision on the budget. As an HR professional, you must practice calculating the ROI of your previous employee engagement initiative to build a strong proposition.

In case you are new, here are a few ways to calculate the ROI of employee engagement:

- How to calculate productivity: To calculate the ROI of increased productivity, you can determine the average cost of an employee and the average number of hours they work per year. Then, calculate the increase in productivity (in terms of output or revenue) and divide it by the total cost of the employee engagement initiative.

- How to calculate retention rates: To calculate the ROI of higher retention rates, you can determine the average cost of hiring and training a new employee. Then, calculate the number of employees that were retained as a result of the employee engagement initiative and multiply it by the average cost of hiring and training a new employee.

- How to calculate improved customer service: To calculate the ROI of improved customer service, you can determine the average value of a customer and the average lifetime value of a customer. Then, calculate the increase in customer satisfaction or loyalty as a result of the employee engagement initiative and multiply it by the average or lifetime value of a customer.

“The best way to pitch employee engagement to a CFO is to approach them with facts and figures on how implementing an employee engagement program will specifically benefit your company. Rather than approaching them with an abstract set of data, providing them with data that’s specific will help make your case much stronger. You should also provide a breakdown of what the cost of implementing the program would be compared to the potential profits it could lead to. This is the best way to prove the ROI and to show that it can be done without breaking the bank.”

How to build a CFO-pro plan for employee engagement?

Now that you have a complete understanding of why employee engagement is important for the business and how you can calculate its ROI. The next step is to build an impactful plan for employee engagement that resonates with your organization’s Chief Financial Officer (CFO).

Here are some tips for building a CFO-pro plan:

Identify key metrics and targets that your CFO cares about:

Identify key metrics and targets that your CFO cares about:

The first step in building a CFO-pro plan is to understand what metrics and targets your CFO is most interested in. This may include things like revenue, profits, cost savings, or efficiency. By identifying these key metrics, you can tailor your employee engagement plan to show how it directly contributes to these targets.

Explain how employee engagement is directly related to revenue generation:

Explain how employee engagement is directly related to revenue generation:

It is important to be able to demonstrate the link between employee engagement and revenue generation. For example, taking the help of the formulas mentioned above you could show how engaged employees are more productive and efficient, leading to increased output and revenue. You could also show how engaged employees are more likely to provide excellent customer service, leading to increased customer satisfaction and loyalty, which can drive revenue growth.

Talk about the success/failure of your existing employee engagement initiatives:

Talk about the success/failure of your existing employee engagement initiatives:

If your organization has already implemented employee engagement initiatives, it is important to share the results with the CFO. This will help to demonstrate the effectiveness of employee engagement initiatives and provide evidence for the value of investing in employee engagement. If some initiatives have been more successful than others, be sure to share the lessons learned and how you plan to apply those insights to future initiatives.

Address the existing and potential concerns and challenges of employees:

Address the existing and potential concerns and challenges of employees:

It is important to consider the needs and concerns of your employees when building an employee engagement plan. This may include things like work-life balance, career development opportunities, and opportunities for growth and advancement. By addressing these concerns, you can help to create a more targeted plan.

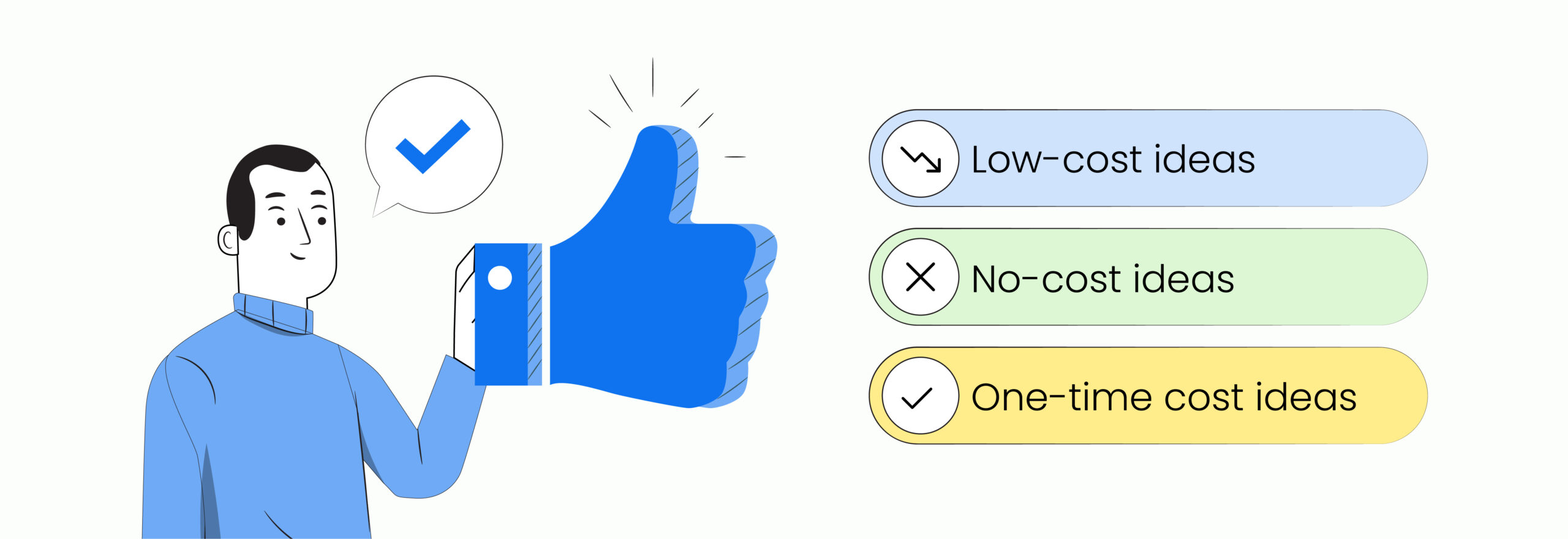

Propose three types of employee engagement initiatives:

Propose three types of employee engagement initiatives:

To create a well-rounded employee engagement plan, it is helpful to propose a mix of low-cost, no-cost, and one-time cost initiatives.

Here are some examples of each type of initiative:

- Low-cost ideas: Ideas for employee engagement that require minimal financial investment, such as team lunches, e-learning platforms, sports events, personal achievement celebrations, and more.

- No-cost ideas: A few ideas for employee engagement that do not require any financial investment, such as flexible work hours, shout-outs on email, recognition and appreciation meetings, and mentor programs.

- One-time cost ideas: Investing in AI-powered employee engagement platforms is the best example of an employee engagement initiative that requires a one-time financial investment. Such platforms can provide organizations with the tools and resources they need to engage employees effectively and improve their overall performance.

“The key is to be people-forward in the conversation. Secondly, leave the financial aspect of the conversation last and emphasize the return on investment. This makes your pitch more attractive and softens the financial blow. Using things like surveys, observing employees, and learning more about them will be the keys to helping you develop your data for the plan. As far as expenses go, cater to the team. It could be something as simple as implementing casual Fridays or having a Christmas party. Don’t overcomplicate it.”

Anticipating and addressing objections from the CFO

Just like any other proposition, you will have to face a rain of questions. Therefore, anticipating objections from the CFO on your employee engagement plan can help you stay one step ahead. This step is crucial to secure funding and support for your proposed initiative. The CFO is likely to have concerns about the cost of the plan and the potential return on investment.

Here are a few tips on how you can address the objections:

Providing detailed cost estimates and a clear budget plan:

Providing detailed cost estimates and a clear budget plan:

It is important to demonstrate the financial viability of the plan. This includes outlining the specific costs associated with each aspect of the plan and how they will be financed. A clear budget plan can alleviate concerns about the cost of the initiative and provide transparency about how the funds will be allocated.

Offering alternative funding options:

Offering alternative funding options:

Such as seeking external grants or partnerships, can offset the costs of the plan and provide additional resources to support its implementation. This can make the plan more appealing to the CFO and other key decision-makers who may be concerned about the cost of the initiative.

Identifying potential areas for cost-saving:

Identifying potential areas for cost-saving:

It is important to identify cost-efficiency within the plan that can reduce the overall cost of the initiative and make it more appealing to the CFO. This can include identifying ways to streamline processes, reduce unnecessary expenses, or improve the overall efficiency of the plan.

Demonstrating the potential long-term financial benefits:

Demonstrating the potential long-term financial benefits:

Advantages of the plan is essential to build support for the initiative among key decision-makers, including the CFO. Employee engagement initiatives can improve employee satisfaction and productivity, which can lead to increased revenue and reduced turnover costs. By highlighting these financial benefits, you can show the CFO that the plan is not only cost-effective but also has the potential to generate significant long-term financial returns for the company.

“Don’t try to build an employee engagement pitch that has a ‘pie in the sky’ ROI. You’re CFO won’t take something like that seriously. It’s too easy to poke holes in your assumptions and generate doubt across the leadership team. Focus on the qualitative benefits of the investment. Have a series of metrics you will track in conjunction with the qualitative metrics, but don’t pretend like your initiatives will be the only things that move the needle on those metrics. Have a phased approach with a series of experiments. Implement some of your ideas in a localized area. Track the qualitative (surveys, 1-on-1s, etc) and quantitative results. As you see an impact then look to expand later in the year.”

In conclusion, it is important to emphasize the long-term benefits of employee engagement when proposing an initiative to improve engagement among employees. These benefits include increased employee satisfaction and productivity, which can lead to increased revenue and reduced turnover costs. By highlighting these long-term benefits, HR professionals can make a strong case for investing in employee engagement.

Finally, investing in the right technology can provide organizations with the precise tools and resources they need to engage employees effectively and improve their overall performance. By investing in intelligent employee engagement platforms, organizations can reap the long-term benefits of employee engagement while also reducing the costs associated with it.